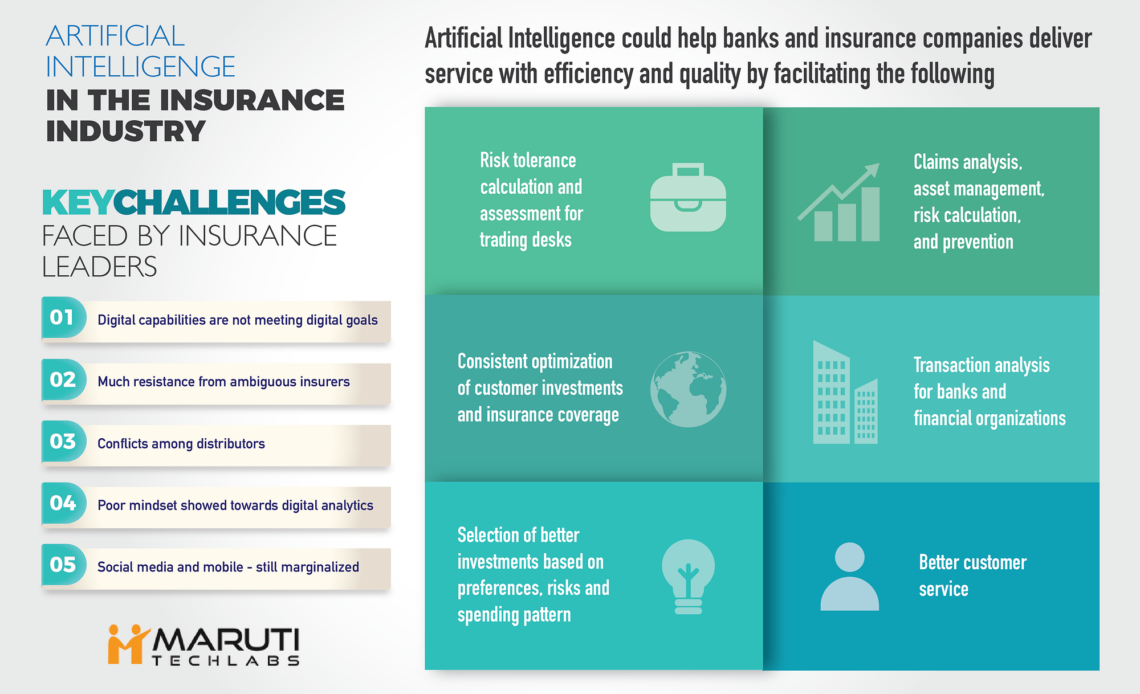

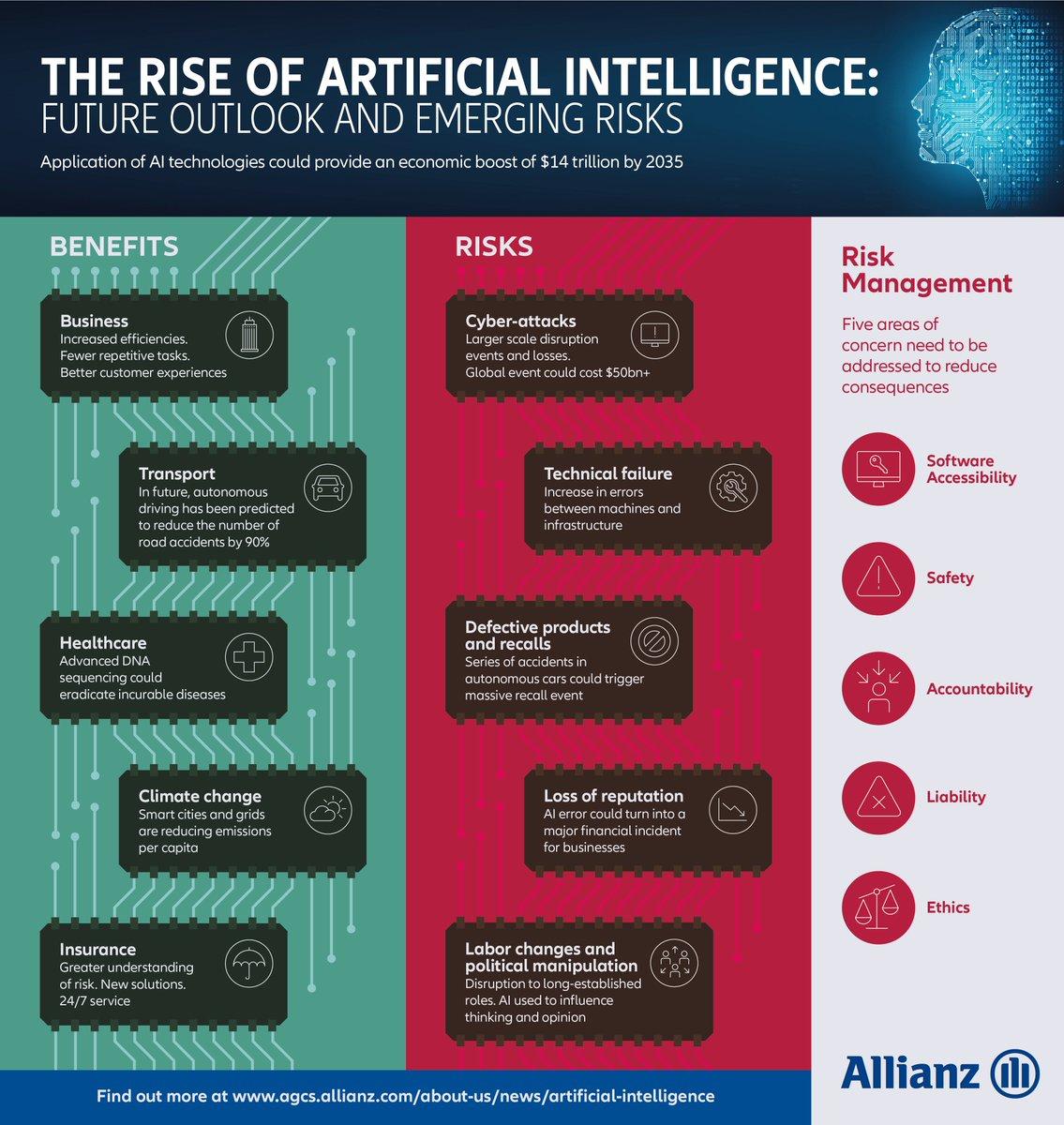

Artificial intelligence in insurance has the potential to revolutionize customer experience and boost sales. From chatbots to risk analysis and fraud detection, AI is revolutionizing many aspects of this industry.

Insurance companies possess an invaluable wealth of unstructured data which can be leveraged for improved customer engagement, service and marketing. AI helps insurers reach the right customers, boost sales volumes and reduce expenses.

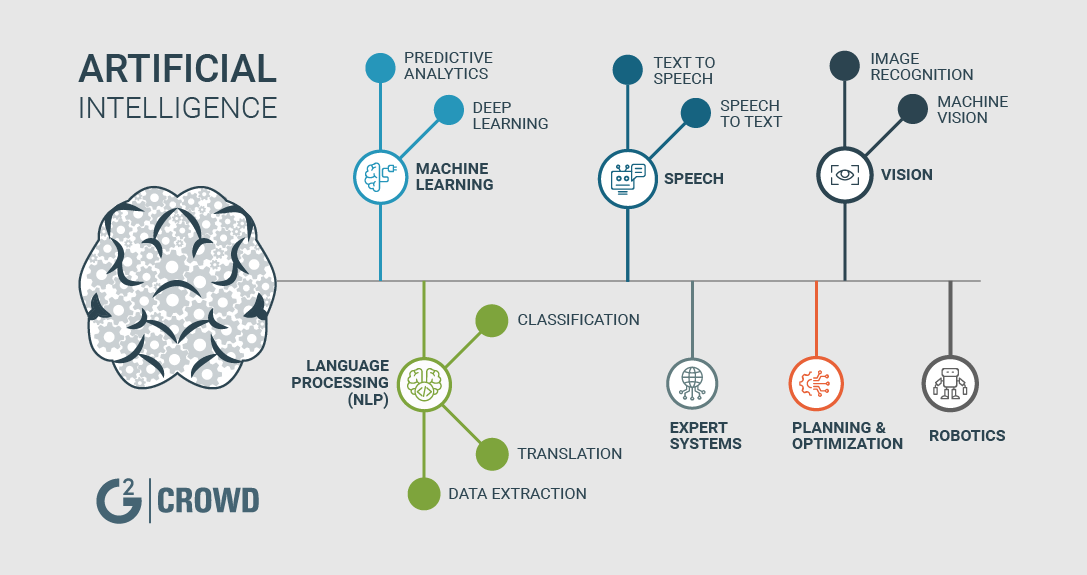

Machine Learning

Machine learning is an indispensable asset in the insurance industry, helping companies automate processes and reduce expenses. Furthermore, it enables insurers to offer customers a more personalized experience.

Insurance companies possess a wealth of data which can be utilized to build artificial intelligence systems that will enhance customer service, risk management and coverage processes. Furthermore, this data helps detect fraud and other issues.

AI can also assist the insurance industry with regulatory compliance. It scans policies and claim documents to guarantee they adhere to all necessary regulations.

Predicting how much a customer will receive for a claim can be very useful. This involves analyzing multiple insurance policies and thoroughly scrutinizing every detail. Once verified by an insurance agent, these results are confirmed. While this process takes considerable time, it has both advantages for both parties involved: speedier processing time and better predictions of payout amounts.

Natural Language Processing

Artificial intelligence (AI) in insurance is becoming a crucial tool for companies to enhance customer experiences. It allows insurers to streamline and accelerate internal processes, boost operational efficiency and boost profit margins.

One of the most widespread AI applications is natural language processing (NLP). NLP allows computers to read and comprehend human text through a combination of traditional linguistics and machine learning techniques for text analysis.

NLP-based solutions can automate many claim processes, reduce costs and errors, and enhance customer satisfaction. For instance, NLP-powered tools can automatically cross-verify insurance claims forms with policy details to screen them for fraudulence.

NLP-based solutions can automate Know Your Customer (KYC) due diligence by extracting KYC information from documents related to a claim. This complies with FINRA Rule 2090 and shields companies from fraud and corruption.

Chatbots

Insurance customers expect personalized and high-quality support from their insurers, whether they’re purchasing a policy or filing an insurance claim. AI-powered chatbots can play an essential role in this journey by offering customers AI-powered options to improve customer experiences.

When a new customer contacts an insurer, chatbots can automatically gather all necessary information and offer customized solutions within seconds. This is an effective way to attract prospective clients and turn them into buyers.

Chatbots can help insurers automate many tasks that require human interaction, such as customer service, insurance claims processing, and policy renewals. Doing so saves staff time and cuts operational expenses.

An intelligent chatbot that utilizes natural language processing can answer 80% of queries support agents receive daily, freeing them up to focus on more complex cases. This improves team productivity and increases client satisfaction levels.

Deep Learning

Artificial intelligence (AI) in insurance offers many advantages, such as creating better underwriting models and price predictions, as well as improving customer service and claims handling. AI also enables the industry to collect more data from customers, giving it insights into their behavior so it can tailor product offerings accordingly.

Finally, deep learning has the potential to revolutionize all aspects of insurance, from sales and distribution through creating an advanced recommendation engine that helps distributors make informed decisions based on the vast amounts of transactional data they generate daily.

One application of deep learning is to assist insurance agents assess claims more quickly and accurately. With AI, claims managers can look through images and other data to estimate how much a customer should expect for their claim; this drastically shortens the process while saving the insurer money.